| Revised Classification applicable w.e.f 1st July 2020 | |||

| Composite Criteria: Investment in Plant & Machinery/equipment and Annual Turnover | |||

| Classification | Micro | Small | Medium |

| Manufacturing Enterprises and Enterprises rendering Services | Investment in Plant and Machinery or Equipment: Not more than Rs.1 crore and Annual Turnover ; not more than Rs. 5 crore | Investment in Plant and Machinery or Equipment: Not more than Rs.10 crore and Annual Turnover ; not more than Rs. 50 crore | Investment in Plant and Machinery or Equipment: Not more than Rs.50 crore and Annual Turnover ; not more than Rs. 250 crore |

Existing MSME Classification | ||||

Sector | Criteria | Micro | Small | Medium |

Manufacturing | Investment | < Rs.25 lakh | < Rs.5 crore | < Rs.10 crore |

Services | Investment | < Rs.10 lakh | < Rs.2 crore | < Rs.5 crore |

Revised MSME Classification | |||

Criteria | Micro | Small | Medium* |

Investment & Annual Turnover | < Rs.1 crore & < Rs.5 crore | < Rs.10 crore & < Rs.50 crore | < Rs.50 crore & < Rs.250 crore |

- To do the registration the small and medium scale industry owner has to fill a single form which he can do online as well as offline.

- If a person wants to do registration for more than one industry then also he/she can do individual registration.

- To do the registration he/she has to fill a single form which is available at the website which is listed below.

- The document required for the registration is Personal Aadhar number, Industry name, Address, bank account details and some common information.

- In this, the person can provide self-certified certificates.

- There are no registration fees required for this process.

- Once the detail-filled and upload you would be getting the registration number.

- Due to the MSME registration, the bank loans become cheaper as the interest rate is very low around ~ 1 to 1.5%. Much lower than interest on regular loans.

- There are various tax rebates offered to MSME.

- It also allowed credit for minimum alternate tax (MAT) to be carried forward for up to 15 years instead of 10 years

- There are many government tenders which are only open to the MSME Industries.

- They get easy access to credit.

- Once registered the cost getting a patent done, or the cost of setting up the industry reduces as many rebates and concessions are available.

- Business registered under MSME are given higher preference for government license and certification.

- There is a One Time Settlement Fee for non-paid amounts of MSME.

- Business Address Proof

- Copies of Sale Bill and Purchase Bill

- Partnership Deed/ MoA and AoA

- Copy of Licenses and Bills of Machinery Purchased

International MSME Day 2019: Finding Solutions to MSME Challenges

The world is celebrating International MSME Day 2019 today, and as a country with the largest number of MSMEs globally, it’s only fair we discuss how far we have come in contributing to the sector as an economy.

International MSME Day 2019 is not just recognised as a day to celebrate the growth of MSMEs, but also to identify the challenges and provide solutions for the sector. Currently, MSMEs have around 50 million businesses, create employment of about 70 million and manufacture more than 6000 products daily.

The MSME sector accounts for about 45% of the manufacturing output and around 40% of the total export of the country.

The main challenges MSMEs face today revolve around:

- Working Capital & Access to Credit

- Shipping & Logistics

- Skill Development

How are MSMEs important to India?

India relies on MSMEs to keep a track of economic growth. The MSME sector contributes significantly to the manufacturing output, employment and exports of the country.

MSMEs are the backbone for India’s digital economy. Over the many years, it has grown, MSMEs have seen higher and faster growth than any other industrial sector.

How? MSMEs are:

- Providing employment

- Contributing to countries GDP

- Possess an Annual Growth Rate of 19%.

However, despite these developments, MSMEs are struggling to live up to the potential contribution to the economic growth of the country. A push towards helping MSME growth accelerate will not only increase contribution to the country’s GDP but it will also help in generating jobs in the country.

MSME Challenges and Solutions:

Indian MSMEs are contributing around 8 % in GDP and 45 % in industrial production. Compared to other countries like China, Japan and Korea, where MSMEs contribute around 50–60% in GDP figures, the Government and RBI have to make larger strides to boost the sector.

This year, the focus has shifted to help MSMEs tackle access to loans and credit, provide technical skills in order to keep up with demands and enable easier shipping of products.

We picked the top 3 challenges that MSMEs are facing currently, based on statistics, and stated the best possible solutions for them too.

Working Capital & Access to Credit:

MSMEs have worked hard to respond to the alterations made by the RBI and Government in the past. However, MSMEs primary challenge lies with easy access to finance, more specifically, working capital.

Running daily operations can become a hurdle for small businesses that do not have easy access to credit. This is also because lending to MSMEs has not been a favourable space for large banking institutions due to their stringent credit appraisal techniques.

This is mainly due to several businesses under the MSME sector:

- Not having a good credit score

- Working primarily on a daily cash basis, which is their working capital.

Post demonetisation, MSMEs could not risk withdrawing cash from their accounts. This resulted in job losses as several contractual based employees were laid off due to an inability on part of the owner to pay them in cash.

Solutions:

First, the RBI and Government have worked closely together to understand MSME cash flows management and provide easier loans to expand production. The RBI pushed for the digitization of MSMEs and established schemes to promote digital payments in the country to meet the lack of cash availability.

Top incentives that have been introduced by the RBI and Government include:

- SMEs can get loans up to 1 crore sanctioned in 59 minutes

- GST exemption limit doubled to 40 Lakh annual turnover; 20 Lakh for the NorthEastern States.

- MSMEs can avail the composition scheme to file just one annual return and pay taxes only once every quarter.

- Allowing a restructuring for MSME Loans up to INR 25 Crore.

What are the documents required for MSME Registration?

No document required for MSME Registration / SSI Registration. Only information provided in Application Form is enough.

Any entrepreneur having valid Aadhaar Number can apply for MSME Registration with Below Criteria:

Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below:

- A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh;

- A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore;

- A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore.

- In case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and the items specified by the Ministry of Small Scale Industries vide

- its notification No.S.O.1722(E) dated October 5, 2006 .

Enterprises engaged in providing or rendering of services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006 are specified below:

- A micro enterprise is an enterprise where the investment in equipment does not exceed Rs. 10 lakh;

- A small enterprise is an enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crore;

- A medium enterprise is an enterprise where the investment in equipment is more than Rs. 2 crore but does not exceed Rs. 5 crore

Is physical copy of Certificate will be issued?

In the interest of environment no physical copy of MSME Certificate will be issued. Government believes in paperless work.

Is Aadhaar Number mandatory for MSME Registration?

At present Aadhaar Number is mandatory for issuance of MSME Certificate.

What is the definition of MSME?

The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 in terms of which the definition of micro, small and medium enterprises is as under: Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below:

- A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh;

- A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore;

- A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore.

What is the support available for technology upgradation?

Ministry implements a scheme called Credit Linked Capital Subsidy Scheme (CLCSS) for technology upgradation of Micro and Small enterprises in the country. Under the scheme, 15 per cent capital subsidy, limited to maximum of Rs 15 lakh (12 % prior to 29.09.2005 limited to maximum of Rs 4.8 lakh) is provided to the eligible MSEs for upgrading their technology with the well-established and improved technology as approved under the scheme. 48 products/sub-sectors have been approved under the CLCSS till date. If you are an MSE manufacturing a product and want to upgrade the technology of manufacturing the product with the well-established and improved technology as approved under the Scheme, then you may have to approach to the nodal agencies/eligible financial institution for sanction of term loan for purchase of eligible machinery.

What is the support available for Skill Development?

The Ministry conducts various types of training programme through its various organisations for self employment as well as wage employment. The training programmes are primarily focused to promote self employment in the country. Thus all type of programmes have input which provide necessary information and skills to a trainee to enable him to establish his own micro or a small enterprises. The programmes include two week Entrepreneurship Development Programme (EDP), Six Week Entrepreneurship Skill Development Programme (ESDP). One weak Management Development Programme (MDP), One Day Industrial Motivation Campaign(IMC) etc. For Monitoring of the programme a web based system has been developed where coordinator of the programme is bound to feed all details of trainees including his photo and phone no. on the website. The same will be linked to the call centre of Ministry where real time feedback is obtained from trainees.

What is meant by Priority Sector Lending?

Priority sector lending include only those sectors, as part of the priority sector that impact large sections of the population, the weaker sections and the sectors which are employment-intensive such as agriculture, and Micro and Small enterprises. Detailed guidelines on Priority sector lending are available in RBI Master Circular.

Are there specialized bank branches for lending to the MSMEs?

Public sector banks have been advised to open at least one specialized branch in each district. The banks have been permitted to categorize their MSME general banking branches having 60% or more of their advances to MSME sector, as specialized MSME branches for providing better service to this sector as a whole. As per the policy package announced by the Government of India for stepping up credit to MSME sector, the public sector banks will ensure specialized MSME branches in identified clusters/centres with preponderance of small enterprises to enable the entrepreneurs to have easy access to the bank credit and to equip bank personnel to develop requisite expertise. Though their core competence will be utilized for extending finance and other services to MSME sector, they will have operational flexibility to extend finance/render other services to other sectors/borrowers.

How do banks assess the working capital requirements of borrowers?

The banks have been advised by RBI to put in place loan policies governing extension of credit facilities for the MSE sector duly approved by their Board of Directors Vide RBI circular; RPCD.SME & FS.BC.No.102/06.04.01/2008-09 dated May 4, 2009 ). Banks have, however, been advised to sanction limits after proper appraisal of the genuine working capital requirements of the borrowers keeping in mind their business cycle and short term credit requirement. As per Nayak Committee Report, working capital limits to SSI units is computed on the basis of minimum 20% of their estimated turnover up to credit limit of Rs.5crore. For more details paragraph 4.12.2 of the RBI Master Circular on lending to the MSME sector dated July 1, 2010 may please be seen.

What is Cluster financing?

Cluster based approach to lending is intended to provide a full-service approach to cater to the diverse needs of the MSE sector which may be achieved through extending banking services to recognized MSE clusters. A cluster based approach may be more beneficial (a)in dealing with well-defined and recognized groups (b) availability of appropriate information for risk assessment (c) monitoring by the lending institutions and (d) reduction in costs. The banks have, therefore, been advised to treat it as a thrust area and increasingly adopt the same for SME financing. United Nations Industrial Development Organisation (UNIDO) has identified 388 clusters spread over 21 states in various parts of the country. The Ministry of Micro, Small and Medium Enterprises has also approved a list of clusters under the Scheme of Fund for Regeneration of Traditional Industries (SFURTI) and Micro and Small Enterprises Cluster Development Programme (MSE-CDP) located in 121 Minority Concentration Districts. Accordingly, banks have been advised to take appropriate measures to improve the credit flow to the identified clusters. Banks have also been advised that they should open more MSE focused branch offices at different MSE clusters which can also act as counseling. Centres for MSEs. Each lead bank of the district may adopt at least one cluster (Refer circular RPCD.SME & NFS.No.BC.90/06.02.31/2009-10 dated June 29, 2010 )

Why is credit rating of the micro small borrowers important?

With a view to facilitating credit flow to the MSME sector and enhancing the comfort-level of the lending institutions, the credit rating of MSME units done by reputed credit rating agencies and it should be encouraged. Banks are advised to consider these ratings as per availability and wherever appropriate structure their rates of interest depending on the ratings assigned to the borrowing SME units.

What is the definition of a sick unit?

As per the extant guidelines, a Micro or Small Enterprise (as defined in the MSMED Act 2006) may be said to have become Sick, if Any of the borrower account of the enterprise remains NPA for three months or more. OR There is erosion in the net worth due to accumulated losses to the extent of 50% of its net worth during the previous accounting year. This criterion enables banks to detect sickness at an early stage and facilitate corrective action for revival of the unit.

How many such specialized branches for lending to MSMEs are there?

As on March 2013 there are 2032 specialized MSME branches.

Is there any provision for grant of composite loans by banks?

A composite loan limit of Rs.1 crore can be sanctioned by banks to enable the MSME entrepreneurs to avail of their working capital and term loan requirement through Single Window in terms of RBI Master Circular on lending to the MSME sector dated July 1, 2010. All scheduled commercial banks have been advised by our circular RPCD.SME & NFS. BC.No.102/06.04.01/2008-09 on May 4, 2009 that the banks which have sanctioned term loan singly or jointly must also sanction working capital (WC) limit singly (or jointly, in the ratio of term loan) to avoid delay in commencement of commercial production thereby ensuring that there are no cases where term loan has been sanctioned and working capital facilities are yet to be sanctioned. These instructions have been reiterated to schedule commercial banks on March 11, 2010.

What support is provided by the Ministry for improving manufacturing competitiveness?

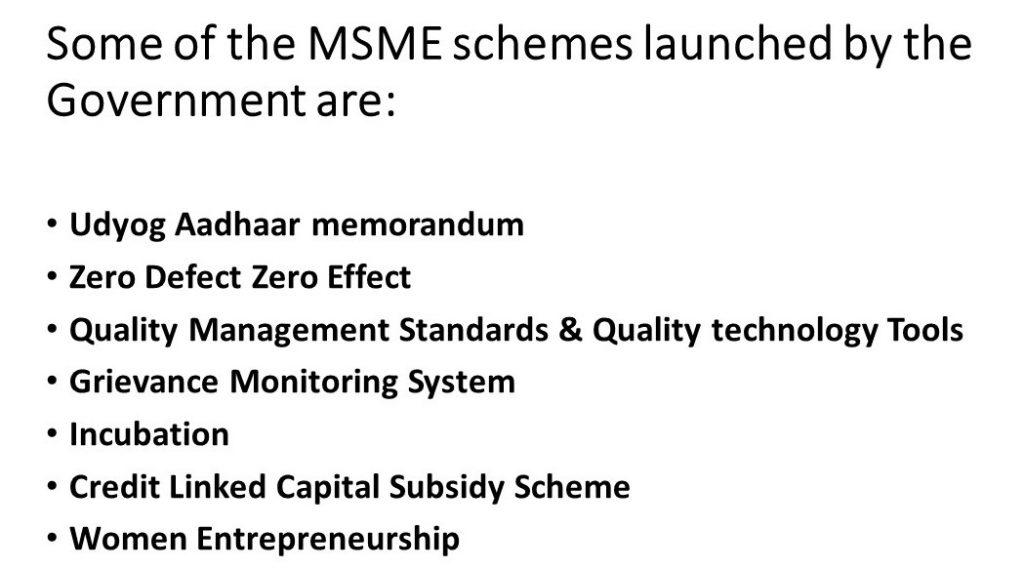

The National Manufacturing Competitiveness Programme (NMCP) is the nodal programme of the Government to develop global competitiveness among Indian MSMEs. The Programme was initiated in 2007-08. This programme targets at enhancing the entire value chain of the MSME sector through the following schemes: (a) Lean Manufacturing Competitiveness Scheme for MSMEs;

(b) Promotion of Information & Communication Tools (ICT) in MSME sector;

(c) Technology and Quality Up gradation Support to MSMEs;

(d) Design Clinics scheme for MSMEs;

(e) Enabling Manufacturing Sector to be Competitive through Quality Management Standards (QMS) and Quality Technology Tools (QTT);

(f) Marketing Assistance and Technology Up gradation Scheme for MSMEs;

(g) Setting up of Mini Tool Room under PPP Mode;

(h) National campaign for building awareness on Intellectual Property Rights (IPR);

(i) Support for Entrepreneurial and Managerial Development of SMEs through Incubators.

(j) Bar Code under Market Development Assistance (MDA) scheme.

What support is provided by the Ministry to improve quality of products produced in MSME sector?

The TEQUP scheme envisages another activity, namely, Product Quality Certification. The main objective of this scheme is to encourage MSMEs to Acquire Product Certification Licenses from National / International Bodies, thereby improving their competitiveness. The primary objective of this activity is to provide subsidy to MSME units towards the expenditure incurred by them for obtaining product certification licenses from National / International standardization Bodies. Under this Activity, MSME manufacturing units will be provided subsidy to the extent of 75% of the actual expenditure, towards licensing of product to National/International Standards. The maximum GOI assistance allowed per MSME is Rs.1.5 lakh for obtaining product licensing /Marking to National Standards and Rs. 2.0 lakh for obtaining product licensing /Marking to International standards. One MSME unit can apply only once under the scheme period.

What support is provided by the Ministry to adopt latest Quality Management Standards and Quality Technology Tools (QMS/QTT)?

Under the National Manufacturing Competitiveness Programme (NMCP) Scheme, one component is “Enabling MSME manufacturing sector to be competitive through Quality Management Standards/Quality Technology Tools (QMS/QTT)” was initiated in the XIth Five year plan. The main objective of the scheme is to sensitize and encourage MSEs to adopt latest Quality Management Standards/Quality Technology Tools (QMS/QTT) and to keep a watch on sectoral developments by undertaking the stated activities. The major activities under the Scheme are as: a) Introduction of appropriate course modules for technical institutions

b) Organizing awareness campaigns for micro & small enterprises.

c) Organising competition–watch (c-watch).

d) Implementation of quality management standards and quality technology tools in selected micro & small enterprises.

e) Monitoring international study missions.

What support is provided by the Ministry for setting up Business Incubators?

The Ministry implements the Support for Entrepreneurial and Managerial Development of SME’s Through Incubators”. The main purpose of the scheme is to nurture innovative business ideas (new/indigenous technology, processes, products, procedures, etc), which could be commercialized in a year. Under the Scheme, financial assistance between 75% to 85% of the project cost upto maximum of Rs. 8 lakh per idea/unit, provided to Business Incubators (BIs). The BIs are also eligible to avail Rs. 3.78 lakh for infrastructure and training expenses for incubating 10 ideas. Any individual or Micro and Small Industries (MSEs) that has innovative business idea at near commercialisation stage can approach the Business Incubators approved under the scheme. Under the scheme, various institutions like Engineering Colleges, Management Institutions, Research labs, etc. that have in-house incubation facilities and faculty for providing handholding support to new idea/entrepreneur can apply in the prescribed application form.

Whether there is any scheme for assisting MSMEs for Intellectual Property Rights?

Under the National Manufacturing Competitiveness Programme (NMCP) to enhance the competitiveness of the SMEs sector, O/o DC(MSME) is implementing a scheme “Building Awareness on Intellectual Property Rights (IPR)” for the MSME. The objective of the scheme is to enhance awareness of MSME about Intellectual Property Rights (IPRs) to take measure for the protecting their ideas and business strategies. Accordingly, to enable the MSME sector to face the present challenges of liberalisation, various activities on IPR are being implemented under this scheme.

What support is provided by the Ministry for enabling MSMEs to get credit rating?

The Ministry is implementing the Performance & Credit Rating Scheme, the main objective of the which is to provide a trusted third party opinion on the capabilities and creditworthiness of the MSEs so as to create awareness amongst them about the strengths and weakness of their existing operations. This is to provide them an opportunity to improve and enhance their organizational strengths and credit worthiness, so that they can access credit at cheaper rates and on easy terms. NSIC was appointed as nodal agency to implement the scheme on behalf of the Government. Rating under the scheme is being carried out through empanelled rating agencies i.e. Credit Rating Information Services of India Limited (CRISIL), Credit Analysis & Research Limited (CARE), Onicra Credit Rating Agency of India Ltd. (ONICRA), Small and Medium Enterprises Rating Agency of India Ltd. (SMERA), ICRA limited and Brickwork India Ratings. Under this Scheme, rating fee payable by the micro and small enterprises is subsidized for the first year only and that is subject to maximum of 75% of the fee or Rs. 40000/-, whichever is less.

What support is provided by the Ministry for participation of MSMEs in international events?

Under the International Cooperation Scheme, financial assistance is provided on reimbursement basis to the State/Central Government organizations, industries/enterprises Associations and registered societies/trusts and organizations associated with MSME for deputation of MSME business delegation to other countries for exploring new areas of MSMEs, participation by Indian MSMEs in international exhibitions, trade fairs, buyer seller meet and for holding international conference and seminars which are in the interest of MSME sectors. Eligible beneficiary organizations can apply to the Ministry directly to avail the assistance under IC Scheme as per Scheme Guidelines.

What are the guidelines for delayed payment of dues to the MSE borrowers?

With the enactment of the Micro, Small and Medium Enterprises Development (MSMED), Act 2006, for the goods and services supplied by the MSEME units, payments have to be made by the buyers as under:· The buyer is to make payment on or before the date agreed on between him and the supplier in writing or, in case of no agreement, before the appointed day. The agreement between seller and buyer shall not exceed more than 45 days.· If the buyer fails to make payment of the amount to the supplier, he shall be liable to pay compound interest with monthly rests to the supplier on the amount from the appointed day or, on the date agreed on, at three times of the Bank Rate notified by Reserve Bank.· For any goods supplied or services rendered by the supplier, the buyer shall be liable to pay the interest as advised at above.· In case of dispute with regard to any amount due, a reference shall be made to the Micro and Small Enterprises Facilitation Council, constituted by the respective State Government.To take care of the payment obligations of large corporate borrowers to MSEs, banks have been advised that while sanctioning/renewing credit limits to their large corporate borrowers (i.e. borrowers enjoying working capital limits of Rs. 10 crore and above from the banking system), to fix separate sub-limits, within the overall limits, specifically for meeting payment obligations in respect of purchases from MSEs either on cash basis or on bill basis. Banks are also advised by RBI to closely monitor the operations in the sub-limits, particularly with reference to their corporate borrowers’ dues to MSE units by ascertaining periodically from their corporate borrowers, the extent of their dues to MSE suppliers and ensuring that the corporate pay off such dues before the ‘appointed day’ /agreed date by using the balance available in the sub-limit so created. In this regard the relevant RBI circular; IECD/5/08.12.01/2000-01 dated October 16, 2000(reiterated on May 30, 2003, vide circular No. IECD.No.20/08.12.01/2002-03 ) available on RBI website.

When MSME Registration Certificate will be issued?

After filing online msme application form, MSME Registration Certificate will be issued immediately at email.

What are the chances of rejection of Online MSME Application?

Every application will be approved. No application will be rejected. Application will be approved on the basis of information provided by applicant.

What is the difference between MSME Registration and SSI Registration?

There is no difference between MSME Registration and SSI Registration. Earlier MSME Registration was known as SSI Registration

What is the support available for collateral free borrowing?

The Ministry of MSME, Government of India and SIDBI set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) with a view to facilitate flow of credit to the MSE sector without the need for collaterals/ third party guarantees. The main objective of the scheme is that the lender should give importance to project viability and secure the credit facility purely on the primary security of the assets financed. The Credit Guarantee scheme (CGS) seeks to reassure the lender that, in the event of an MSE unit, which availed collateral- free credit facilities, fails to discharge its liabilities to the lender, the Guarantee Trust would make good the loss incurred by the lender up to 85 % of the outstanding amount in default.

What is the support available for cluster development ?

The Ministry is implementing the Micro and Small Enterprises – Cluster Development Programme (MSE-CDP) wherein support is provided for Diagnostic Study; Soft Interventions like general awareness, counseling, motivation and trust building, exposure visits, market development including exports, participation in seminars, workshops and training programmes on technology upgradaion etc; Hard Interventions like setting up of Common Facility Centers (Common Production/Processing Centre, Design Centre, Testing Centre etc.) and creation/upgradation of infrastructural facilities in the new/existing industrial areas/ clusters of MSEs.

What benefits do the Tool Rooms of Ministry of MSME provide to MSMEs?

Tool Rooms are equipped with state-of-the-art machinery & equipment. They are engaged in designing and manufacturing of quality tools, which are necessary for producing quality products, and improve the competitiveness of MSMEs in national and international markets. They also conduct training programmes to provide skilled manpower to industries specially MSMEs. The placement of trainees trained in Tool Room is more than 90%. There are 18 Autonomous Bodies (10 MSME Tool Rooms and 8 Technology Development Centres) under DC (MSME).

Can the MSE borrowers get collateral free loans from banks?

In terms of RBI circular RPCD.SME&NFS.BC.No.79/06.02.31/2009-10 dated May 6, 2010 , banks are mandated not to accept collateral security in the case of loans upto Rs 10 lakh extended to units in the MSE sector. Further, in terms of RBI circular RPCD/PLNFS/BC.No.39/06.02.80/2002-04 dated November 3, 2003 , banks may, on the basis of good track record and financial position of MSE units, increase the limit of dispensation of collateral requirement for loans up to Rs.25 lakh with the approval of the appropriate authority.All scheduled commercial banks that are public/private sector banks and RRbs/NSIC/SIDBI/NETFI are the member lending institutions. (MLI) List of banks offering loans is mentioned below;List of Bank’s MSME Care Centres1.Allahabad Bank2.Bank of Baroda3.O.B.C.4.Andhra Bank5.State Bank of Bikaner & Jaipur6.State Bank of Hyderabad7.Bank of India8.Bank of Maharashtra9.State Bank of Travancore10.Canara Bank11.Dena Bank12.Indian Bank13.I.O.B.14.Punjab & Sind Bank15.P.N.B.16.Syndicate Bank17.UCO Bank18.Union Bank of India19.United Bank of India20.Vijaya Bank21.State Bank of Mysore22.Corporation Bank23.I.D.B.I.24.State Bank of Patiala25.State Bank of India26.Central Bank of India27.State Bank of IndoreLinks of State Level Bankers’ Committees contact address1.SLBC Rajasthan2.SLBC Bihar3.SLBC U.P.4.SLBC Orissa5.SLBC Andhra Pradesh6.SLBC J&K7.SLBC Gujarat8.SLBC West Bengal9.SLBC Kerala10.SLBC Jharkhand11.SLBC Himachal PradeshFee for Guarantee:The fee payable to the Trust under the scheme is one-time guarantee fee of 1.5% and annual service fee of 0.75% on the credit facilities sanctioned. For loans up to Rs.5 lakh, the one-time guarantee fee and annual service fee is 1% and 0.5% respectively. Further, for loans in the North-East Region, the one-time guarantee fee is only 0.75%.

Is there support available for obtaining ISO certification?

In terms of RBI circular, banks are mandated not to accept collateral security in the case of loans The Ministry is implementing the ISO: 9001/14001/HACCP Certification Reimbursement Scheme for Micro & Small Enterprises (MSEs) for reimbursement of certification expenses, only to those MSEs which have acquired Quality Management Systems (QMS)/ISO 9001 and /or Environment Management Systems (EMS)/ ISO14001and / or Food Safety Systems (HACCP) Certification. Under the scheme provides reimbursement of 75% of the certification expenses up to a maximum of Rs.75,000/- (Rupees seventy five thousand only) to each unit as one-time reimbursement only to those MSEs which have acquired Quality Management Systems (QMS)/ISO 9001 and /or Environment Management Systems (EMS)/ ISO14001and / or Food Safety Systems (HACCP) Certification.

What support is provided by the Ministry for assisting training institutions?

The Ministry is implementing the Assisting to Training Institutions Scheme which envisages financial assistance for establishment of new institutions (EDIs), strengthening the infrastructure of the existing EDIs and for supporting entrepreneurship and skill development activities. The main objectives of the scheme are development of indigenous entrepreneurship from all walks of life for developing new micro and small enterprises, enlarging the entrepreneurial base and encouraging self-employment in rural as well as urban areas, by providing training to first generation entrepreneurs and assisting them in setting up of enterprises. The assistance shall be provided to these training institutions in the form of capital grant for creation/strengthening of infrastructure and programme support for conducting entrepreneurship development and skill development programmes.

Are there any targets prescribed for lending by banks to MSMEs?

Are there any targets prescribed for lending by banks to MSMEs? As per extant policy, certain targets have been prescribed for banks for lending to the Micro and Small enterprise (MSE) sector. In terms of the recommendations of the Prime Minister’s Task Force on MSMEs banks have been advised to achieve a 20 per cent year-on-year growth in credit to micro and small enterprises, a 10 per cent annual growth in the number of micro enterprise accounts and 60% of total lending to MSE sector as on preceding March 31st to Micro enterprises. In order to ensure that sufficient credit is available to micro enterprises within the MSE sector, banks should ensure that: 40 per cent of the total advances to MSE sector should go to micro (manufacturing) enterprises having investment in plant and machinery up to Rs. 10 lakh and micro (service) enterprises having investment in equipment up to Rs. 4 lakh ; 20 per cent of the total advances to MSE sector should go to micro (manufacturing) enterprises with investment in plant and machinery above Rs. 10 lakh and up to Rs. 25 lakh, and micro (service) enterprises with investment in equipment above Rs. 4 lakh and up to Rs. 10 lakh. Thus, 60 per cent of MSE advances should go to the micro enterprises.

Is credit rating mandatory for the MSE borrowers?

Credit rating is not mandatory but it is in the interest of the MSE borrowers to get their credit rating done as it would help in credit pricing that is cost of funds (interest and other charges etc.) of the loans taken by them from banks.

What is debt restructuring of advances?

A viable/potentially viable unit may apply for a debt restructuring if it shows early stage of stickiness. In such cases the banks may consider to reschedule the debt for repayment, consider additional funds etc. A debt restructuring mechanism for units in MSME sector has been formulated and advised to all commercial banks. The detailed guidelines have been issued to ensure restructuring of debt of all eligible small and medium enterprises. Prudential guidelines on restructuring of advances have also been issued which harmony the prudential norms over all categories of debt restructuring mechanisms (other than those restructured on account of natural calamities). The relevant circulars in this regard are circular DBOD.BP.BC.No.34/21.04.132/2005-06 dated September 8, 2005 and circularDBOD.No.BP.BC.37/21.04.132/2008-09 dated August 27, 2008 which are available on our website www.rbi.org.in.

Are all sick units put under rehabilitation by banks?

No. If a sick unit is found potentially viable it can be rehabilitated by the banks. The viability of the unit is decided by banks. A unit should be declared unviable only if such a status is evidenced by a viability study.

What is the procedure and time frame for conducting the viability study?

The decision on viability of the unit should be taken at the earliest but not later than 3 months of the unit becoming sick under any circumstances. The following procedure should be adopted by the banks before declaring any unit as unviable: A unit should be declared unviable only if the viability status is evidenced by a viability study. However, it may not be feasible to conduct viability study in very small units and will only increase paperwork. As such for micro (manufacturing) enterprises, having investment in plant and machinery up to Rs. 5 lakh and micro (service) enterprises having investment in equipment up to Rs. 2 lakh, the Branch Manager may take a decision on viability and record the same, along with the justification. The declaration of the unit as unviable, as evidenced by the viability study, should have the approval of the next higher authority/ present sanctioning authority for both micro and small units. In case such a unit is declared unviable, an opportunity should be given to the unit to present the case before the next higher authority. The modalities for presenting the case to the next higher authority may be worked out by the banks in terms of their Board approved policies in this regard The next higher authority should take such decision only after giving an opportunity to the promoters of the unit to present their case. For sick units declared unviable, with credit facilities of Rs. 1 crore and above, a Committee approach may be adopted. A Committee comprising of senior officials of the bank may examine such proposals. This is expected to improve the quality of decisions as collective wisdom of the members shall be utilized, especially while taking decision on rehabilitation proposals. The final decision should be communicated to the promoters in writing. The above process should be completed in a time bound manner and should not take more than 3 months.

What support is provided by the Ministry to promote energy conservation in the manufacturing process for SMEs?

The Ministry implements the “Technology and Quality Upgradation Support to Micro, Small and Medium Enterprises (TEQUP)” which focuses on two important aspects, namely, enhancing competitiveness of MSME sector through Energy Efficiency and Product Quality Certification. The basic objective of this scheme is to encourage MSMEs in adopting energy efficient technologies and to improve product quality of manufacturing in MSMEs. It is a well-known fact that energy consumption is a significant component in the cost structure of almost any manufacturing/ production activity. Adopting energy efficient technologies curtails the cost of energy there by reducing production cost and increasing competitiveness. Under this scheme, a capital subsidy of 25% of the project cost subject to a maximum of Rs. 10.00 lakh shall be provided to the registered MSME units. While 25% of the project cost will be provided as subsidy by the Government of India, the balance amount is to be funded through loan from SIDBI/banks/financial institutions. The minimum contribution as required by the funding agency will have to be made by the MSME unit.

What support is provided by the Ministry to improve design of products produced in MSME sector?

The Ministry implements the Design Clinic Scheme for Design Expertise to Micro, Small and Medium Enterprises (MSME) Sector is to improve the design of the product to meet global challenges and compete with similar products domestically and internationally. It is launched to benefit MSMEs by creating a dynamic platform to provide expert solutions to real time Design problems and add value to existing products. The goal of this scheme is to help MSME manufacturing industries move up the value chain by switching the production mode from original equipment manufacturing to original design manufacturing and hence original brand manufacturing. In the Design Clinic scheme, the value additions to an idea or a concept are imparted through interaction at a lesser cost to a specific industry/sector. The expected outcome of such interventions is new product development by design improvement and value addition for existing products.

Has EM-I/II been replaced by UAM?

Yes. After the notification dated 18-09-2015,filing of EM-I/II by States/UTs should be discouraged and instead all efforts be made to popularize the filing of UAM on the portal.

What is the date for adopting the UAM and stopping EM-I and EM-II?

It is clarified that once the UAM has been notified dated 18-09-15, there cannot be a different cut-off date announced for adopting UAM. However, in order to maintain continuity, the cases of EM-I/II filing under process till 18-09-2015 may be accepted.

Whether the multiple system of registration may exist after introduction of UAM?

All other online/ offline systems of registration of MSMEs created and maintained by Central/State/UT Governments should cease to register new MSMEs forthwith. Such online platforms may be allowed to exist for the time being to enable access to useful legacy data for decision making. Henceforth, there should be only one system i.e. UAM for the registration of new MSME units.

Whether States/UTs have access to reports/ query and such other functions as may be required by GM(DIC)/ Directorate of Industries on the UAM portal?

The Udyog Aadhaar portal has been envisaged to take care of this requirement.

What would be the role of “Udyog Bandhu” in the UAM?

The role of facilitating the creation and growth of enterprises in the States/UTs is not proposed to change in any manner whatsoever through UAM. The concept of “Udyog Bandhu” may therefore not be affected by UAM.

What would happen to those enterprises which do not have Aadhaar Number?

At present Aadhaar Number is mandatory for registration under UAM. However, the GoI will find a way out for covering those cases where Aadhaar Number is not available.

EM-I filed by a prospective enterprise entitles it for certain exemptions from paying stamp-duties. How to handle this in UAM?

Legally, the EM-I/II ceases to exist after 18-09-15. States/UTs may encourage providing all benefits/concessions to MSMEs based on UAM only.

Is there a provision for editing of information in UAM data of an enterprise by GM (DIC)?

No. Howver, GM DICs , on the UAM portal, shall be able to enter their remarks on the respective information provided by the entrepreneurs while filing the UAM online.

What is the monitoring mechanism available to Director(Industries) and GM(DICs) for new registration under UAM?

Since the UAM is being filing on self certification basis and the UAN is generated instantly, there cannot be any monitoring of the registration process. However, the enterprises filing the UAM online are liable to provide documentary proof of information provided in the UAM, wherever necessary, to the Central Government, State Government or such person as may be authorized.

Disclaimer should be added in UAN

Notification clearly states that the UAM filed is on self declaration basis. Therefore, no separate disclaimer is required

Why power load details have not been asked in UAM?

Power load indicates the requirement of energy to the MSME unit. This has no relevance to the activity of the enterprise and the subject matter is dealt by the State/UT Governments.

Is it mandatory to have Aadhaar Number for an entrepreneur to file Udyog Aadhaar memorandum?

The Udyog Aadhaar Registration can be done online by individuals themselves in case they have an Aadhaar number. However, in all exceptional cases, including those of not having Aadhaar number, can still file Udyog Aadhaar Memorandum ,in offline mode(i.e. on paper form), with the General Manager(GM) of the concerned District Industries Centre(DIC). The same has also been notified in the gazette dated 18-09-15.

The persons having Aadhaar numbers, by virtue of having provided the demographic as well as biometric details to the state, once and for all, indeed enjoy a greater ease of registration at the UAM portal.

What is the genesis of Udyog Aadhaar?

The ministry for micro, small and medium enterprises had in September’15 notified Udyog Aadhaar, taking a cue from the prime minister's radio show “Mann Ki Baat”, where he had talked about simplifying procedures to start a business with a single-page registration form.

A large chunk of enterprises in India are simply not registered due to the cumbersome paperwork involved in the process and, therefore, can't tap the government schemes for them. The KV Kamath panel on financing the MSME sector, that has been the biggest job creator in recent years, had recommended that the registration should be universalized.

The concept of Udyog Aadhaar and ease of registration have thus originated to ensure wider coverage of MSMEs to avail the benefits under various Schemes of Central/ State governments.

How should the States/UTs with less coverage under Aadhaar adopt UAM?

Some of the States have less than adequate coverage till date as per the UIDAI data. It has been clarified to such States, such as Assam that the option of assisted filing of UAM in offline mode with the GM (DIC) could be resorted to. Aadhaar number is not a mandatory requirement when the States/UTs have offices in the Districts headed by GM (DICs) and whose primary role is to promote and facilitate industries in the District. The UAM can be filled through the concerned GM (DIC).

The States/UTs have been asked to sensitize their District Industries Centers for a proactive role in Udyog Aadhaar.

How many systems for registration of MSMEs in India are in vogue?

Prior to 18-09-15, when the Entrepreneurs’ Memorandum-II was filled with the GM (DIC), heterogeneous systems were in vogue. Some States had their own online systems for registering MSMEs, some were using the national portal created by Ministry of MSME and some (around 10 states) were continuing with the manual (paper form) system of filing EM-II.

The new system of Udyog Aadhaar offers convergence of all heterogeneous systems to a single system of registration. The system is capable of delivering assured ease of doing business where the UIDAI has coverage i.e. 92% of the country’s adult population.

The Udyog Aadhaar portal has suitable provisions for sharing State/ District specific data of registrations under Udyog Aadhaar with the respective States/ Districts. This initiative of maintaining the data on MSMEs with Ministry of MSME is likely to save cost in the long run since States/UTs would no longer be requiring to maintain the same.

Aadhaar Cards have not been issued in the State of Assam to a very large section of the population till now. The same is creating a problem for entrepreneurs to come forward and file the UAM online. The option of PAN number issued by income tax department may be provided as an alternative to Aadhaar number for filing of UAM.?

States with low coverage under Aadhaar card have been requested during the earlier video conferences to use the offline mode of UAM. The offices of GM (DIC) may assist the entrepreneurs by filing their UAM online. Aadhaar number is not a mandatory requirement for filing UAM. The UAM form in hardcopy duly filled in without Aadhaar number can be submitted to the concerned GM-DICs. GM-DICs have been authorized to file such UAMs without Aadhaar number online.

Government of Assam may accordingly sensitize their District Industries Centers.

The number of employees and amount of investment in the UAM is creating confusion. ?

The number of employees does not have a bearing on the size or type of the enterprise as per the MSMED Act'2006. A single figure indicating "persons employed' is being captured in the UAM

Investment in Land, Building etc. are not material for classification of MSMEs. The Act permits classification only on the basis of the Investment on Plant & Machinery.

The number of employees and amount of investment in the UAM is creating confusion. ?

The number of employees does not have a bearing on the size or type of the enterprise as per the MSMED Act'2006. A single figure indicating "persons employed' is being captured in the UAM

Investment in Land, Building etc. are not material for classification of MSMEs. The Act permits classification only on the basis of the Investment on Plant & Machinery.

What support is provided by the Ministry for promotion of Information & Communication Tools (ICT) in MSME Sector ?

The Ministry implements the Information and Communication Technology (ICT) scheme to encourage and assist Indian MSMEs to adopt ICT Tools and Applications in their production and business processes, and thereby improve their productivity and competitiveness in National and International Market.

What scheme does the Ministry have for providing marketing support to MSMEs?

The Ministry implements the Marketing Assistance scheme through National Small Industries Corporation (NSIC) Limited for providing marketing support to MSMEs. The main objectives of the scheme is to enhance the marketing competitiveness of MSMEs; to provide them a platform for interaction with the individual/institutional buyers; to update them with prevalent market scenario and to provide them a form for redressing their problems. MSMEs are supported under the Scheme for capturing the new market opportunities through organising/ participating in various domestic & international exhibitions/ trade fairs, Buyer-Seller meets intensive-campaigns and other marketing events.

What are the RBI guidelines on interest rates for loans disbursed by the commercial banks?

As part of the financial sector liberalization, all credit related matters of banks including charging of interest have been deregulated by RBI and are governed by the banks' own lending policies. With a view to enhancing transparency in lending rates of banks and enabling better assessment of transmission of monetary policy, all scheduled commercial banks had been advised in terms of RBI circular; DBOD.No.Dir.BC.88/13.03.00/2009-10on April 9, 2010 to introduce the Base Rate system w.e.f. July 1, 2010. Accordingly, the Base Rate System has replaced the BPLR (Bank’s prime Lending Rate) system with effect from July 1, 2010. All categories of loans should henceforth be priced only with reference to the Base Rate.

Is there a time frame within which the banks are required to implement the rehabilitation package?

Viable / potentially viable MSE units/enterprises, which turn sick in spite of debt re-structuring, would need to be rehabilitated and put under nursing. It will be for the banks/financial institutions to decide whether a sick MSE unit is potentially viable or not. The rehabilitation package should be fully implemented by banks within six months from the date the unit is declared as potentially viable/viable. During this six months period of identifying and implementing rehabilitation package banks/FIs are required to do “holding operation” which will allow the sick unit to draw funds from the cash credit account at least to the extent of deposit of sale proceeds. The relevant circular on rehabilitation of sick units is RPCD.CO.MSME & NFS.BC.40/06.02.31/2012-2013 dated November 1, 2012 is available on our website.

What are the RBI guidelines on One Time Settlement scheme(OTS) for MSEs for settlement of their NPAs?

Scheduled commercial banks have been advised in terms of our circular RPCD.SME&NFS. BC.No.102/06.04.01/2008-09 dated May 4, 2009 to put in place a non -discretionary One time Settlement scheme duly approved by their Boards. The banks have also been advised to give adequate publicity to their OTS policies.

What is the full form of NIC & their details?

NIC stands for National Industrial Classification & Classification Details Link - https://udyogaadhaar.gov.in/UA/Document/nic_2008_17apr09.pdf

What is the other option for MSME if online filing is not possible for any reasons?

A Hard copy of the form link - https://udyogaadhaar.gov.in/Web/doc/English.pdf download & fill and send it to 9619009184 OR info.clickdocs@gmail.com

MSME / Udyog Aadhaar Registration necessary who already having SSI(Small Scale Industry Registration) i.e. Entrepreneurship Memorandum-I or Entrepreneurship Memorandum-II?

As per the Micro, small and medium enterprises development act, 2006 (27 of 2006) shall not be required to file Udyog Aadhaar Memorandum, but if they so desire, they may also file the MSME / Udyog Aadhaar Registration.

What are the Activities (NIC Codes) not covered under MSMED Act, 2006 for registration of Udyog Aadhaar?

This Business category i,e, Activities (NIC Codes) Not Covered Under MSME - https://udyogaadhaar.gov.in/Web/doc/Activities_NIC_CodesNotAllowed.PDF

Does the Ministry have any scheme for providing handholding support and assistance to potential entrepreneurs?

The Ministry implements the Rajiv Gandhi Udyami Mitra Yojana (RGUMY), objective of which is to provide handholding support and assistance to the potential first generation entrepreneurs, who have already successfully completed Entrepreneurship Development / Skill Development Training. Selected lead agencies i.e ‘Udyami Mitras’, provide information and guidance to first generation entrepreneurs regarding various promotional schemes of the Government, procedural formalities required for setting up and running of the enterprises and help them in accessing Bank credit etc. A ‘Udyami Helpline’ (a Call Centre for MSMEs) with a toll free No. 1800-180-6763 has also been set up to assist the entrepreneurs.KEY WORDSCredit Guarantee Capital Subsidy Cluster Development Skill DevelopmentTool Rooms Manufacturing Competitiveness Lean Manufacturing Design Clinics Quality Management Standards (QMS) Quality Technology Tools (QTT);Marketing Assistance on Intellectual Property Rights (IPR); Business IncubatorsBar Code Energy ConservationISO certificationCredit RatingInternational Cooperation Marketing Marketing Assistance.

Does the Ministry have any scheme for providing handholding support and assistance to potential entrepreneurs?

The Ministry implements the Rajiv Gandhi Udyami Mitra Yojana (RGUMY), objective of which is to provide handholding support and assistance to the potential first generation entrepreneurs, who have already successfully completed Entrepreneurship Development / Skill Development Training. Selected lead agencies i.e ‘Udyami Mitras’, provide information and guidance to first generation entrepreneurs regarding various promotional schemes of the Government, procedural formalities required for setting up and running of the enterprises and help them in accessing Bank credit etc. A ‘Udyami Helpline’ (a Call Centre for MSMEs) with a toll free No. 1800-180-6763 has also been set up to assist the entrepreneurs.KEY WORDSCredit Guarantee Capital Subsidy Cluster Development Skill DevelopmentTool Rooms Manufacturing Competitiveness Lean Manufacturing Design Clinics Quality Management Standards (QMS) Quality Technology Tools (QTT);Marketing Assistance on Intellectual Property Rights (IPR); Business IncubatorsBar Code Energy ConservationISO certificationCredit RatingInternational Cooperation Marketing Marketing Assistance.

What is the status of lending by banks to this sector?

Bank’s lending to the Micro and Small enterprises engaged in the manufacture or production of goods specified in the first schedule to the Industries (Development and regulation) Act, 1951 and notified by the Government from time to time is reckoned for priority sector advances. However, bank loans up to Rs.5 crore per borrower / unit to Micro and Small Enterprises engaged in providing or rendering of services and defined in terms of investment in equipment under MSMED Act, 2006 are eligible to be reckoned for priority sector advances. Lending to Medium enterprises is not eligible to be included for the purpose of computation of priority sector lending. Detailed guidelines on lending to the Micro, Small and Medium enterprises sector are available in our Master Circular no. RPCD.MSME & NFS.BC.No.5/06.02.31/2013-14 dated July 1, 2013 . The Master circulars are issued by RBI, to banks, on various matters are available on RBI website www.rbi.org.in and updated in July each year.

Apart from the loans and other banking facilities, do the banks provide any guidance to MSE entrepreneurs?

Banks provide following services to the MSE entrepreneurs:Rural Self Employment Training Institutes (RSETIs)At the initiatve of the Ministry of Rural Development (MoRD), Rural Self Employment Training Institutes (RSETIs) have been set up by various banks all over the country. These RSETIs are managed by banks with active co-operation from the Government of India and State Governments. RSETIs conduct various short duration (ranging preferably from 1 to 6 weeks) skill upgradation programmes to help the existing entrepreneurs compete in this ever-changing global market. RSETIs ensure that a list of candidates trained by them is sent to all bank branches of the area and co-ordinate with them for grant of financial assistance under any Govt. sponsored scheme or direct lending.Financial Literacy and consultancy support: Banks have been advised to either separately set up special cells at their branches, or vertically integrate this function in the Financial Literacy Centres (FLCs) set up by them, as per their comparative advantage. Through these FLCs, banks provide assistance to the MSE entrepreneurs in regard to financial literacy, operational skills, including accounting and finance, business planning etc. (Refer circular RPCD.MSME & NFS.BC.No.20/06.02.31/2012-13 dated August 1, 2012 ) Further, with a view to providing a guide for the new entrepreneurs in this sector, a booklet titled “Nurturing Dreams, Empowering Enterprises – Financing needs of Micro and Small Enterprises – A guide” has been launched on August 6, 2013 by the Reserve Bank. The booklet has been placed on our website www.rbi.org.in under the following path & URL: RBI main page – Financial Education – Downloads – For Entrepreneurs (http://rbi.org.in/financialeducation/FinancialEnterprenure.aspx)

Sitemap

- Home

- About Us

- What's MSME

- Acts & Rules

- Documents

- Schemes

- Vacancies

- Newsletter

- Download Latest Edition

- News - Around the Ministry

- SCHEMES

- Articles

- Innovations moulding Indias development

- From the Desk of JS-SME

- From the Desk of ADC

- From the desk of JS (SME)

- India's footwear industry

- International SME Convention 2019

- Women Entrepreneurs

- Fragrance & Flavour Industry in India

- A Brief about MSME Tool rooms

- 15th GLOBAL SME BUSINESS SUMMIT

- Vibrant Gujarat Article

- Rise of Handloom to a Global Industry

- Coir Board

- Coir a crucial component for Eco-Sustainability

- Information Technology leading path of Indian MSMEs to march as Champions

- Upcoming Activities Training

- GST-MSME

- Covid - 19

- Quick Links

- Technology Development Fund Scheme of Defence Re search and Development Organisation (DRDO) – reg.

- Safety & Quality Forum

- Development Commissioner

- Khadi and Village Industries Commission (KVIC)

- Coir Board

- ni-msme

- Aspirational District Visit

- MSME SAMADHAAN- Delayed Payment Monitoring System

- MSME SAMBANDH

- Udyog AADHAR (Online Registration for MSME)

- Internet Grievance Monitoring System (IGMS)

- eoffice

- Press Information Bureau

- Closure of Companies

- MSME DATA BANK

- Delhi Mumbai Industrial Corridor Development Corporation (DMICDC)

- More

- MOUs

ReplyDeletethe information you have updated is very good and useful,please update further.

if you required any info regarding TAX & GSTR please visit

Fssai Registration in Bangalore

SSI Registration in Bangalore

I love reading to improve my knowledge and this kind of blogs helps me to do so, Thanks.If you require about SSI Registration Services in bangalore

ReplyDeleteCorporate Tax Consultants in bangalore

Income Tax Returns Filing in bangalore

SSI Registration in bangalore

please check out.

An in fact progressed PDF converter won't simply assist you with completing group transformation.

ReplyDeletepdf-png.com

I will recommend your post to my junior researchers who have the similar doubts. I guess your blog has clear the confusion in very simpler way. Thank you on behalf of them.

ReplyDeleteudyog aadhar apply online